Understanding the Basics When you’re deciding between a 15-year and a 30-year mortgage, it’s important to understand the fundamental differences between the two. A 15-year mortgage generally involves higher monthly payments but allows you to pay off your home more quickly. Conversely, a 30-year mortgage offers lower monthly payments but takes longer to pay off, […]

Understanding Reverse Mortgages A reverse mortgage is a distinct type of financial product that allows homeowners to convert a portion of their home equity into cash, predominantly aimed at individuals over the age of 62. This unique financial solution is primarily designed to provide retirees with a reliable income source, while allowing them to continue […]

Understanding Mortgage Term Lengths When deciding how long your mortgage term should be, it’s essential to consider several factors. The mortgage term length will impact your monthly payments, the total cost of the loan, and how quickly you build equity in your home. Common mortgage terms range from 10 to 30 years, with the 30-year […]

The Link Between Inflation and Mortgage Interest Rates Inflation is commonly understood as the rate at which the general level of prices for goods and services increases, effectively diminishing the purchasing power of currency. This occurrence can have a marked effect on economic elements, such as mortgage interest rates. For both homebuyers and homeowners, understanding […]

Understanding Predatory Mortgage Lending Predatory mortgage lending is a concerning practice within the financial industry that involves unfair, deceptive, or exploitative tactics. These often target borrowers who may not have a full understanding of the loan terms or those who are already experiencing financial difficulty. Recognizing and avoiding these practices is essential to safeguard one’s […]

Understanding Mortgage Options for Self-Employed Borrowers For self-employed individuals, securing a mortgage often presents unique challenges. The primary hurdle stems from the variability in income and the additional documentation requirements. Unlike salaried employees who have a consistent paycheck, self-employed individuals need to navigate through a different set of prerequisites to qualify for a mortgage. However, […]

Consequences of Missing a Mortgage Payment Missing a mortgage payment can bring about various repercussions that may impact your financial situation, credit score, and in some cases, your home ownership status. It is essential for homeowners to recognize and comprehend these consequences so that they can effectively manage their obligations and avoid potential pitfalls. Addressing […]

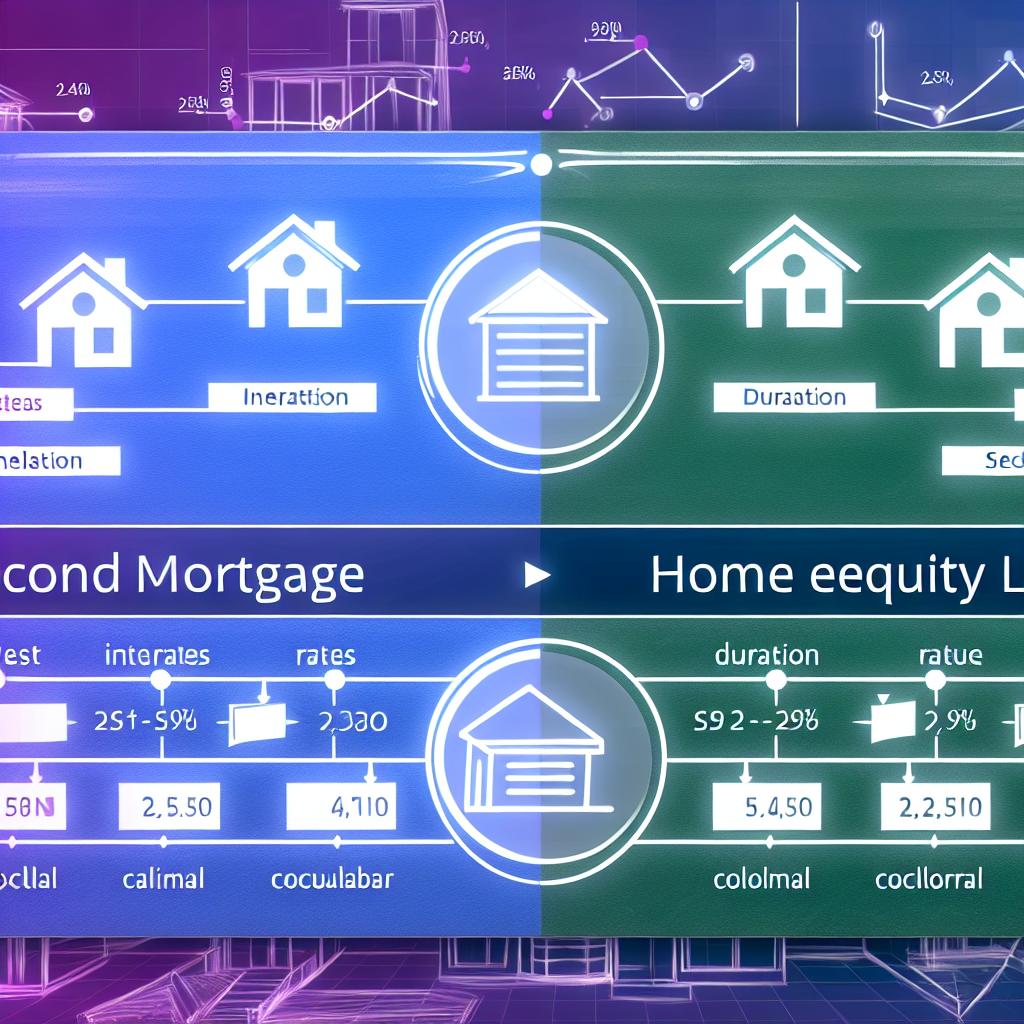

The Differences Between a Second Mortgage and a Home Equity Loan When it comes to leveraging the value of your home, both second mortgages and home equity loans are popular options. While they might seem similar at first glance, these financial products have distinct characteristics. Understanding these differences can help homeowners make informed decisions. Understanding […]

Understanding the Basics of Mortgage Approval Before exploring ways to improve your chances of mortgage approval, it’s essential to understand the factors that lenders consider. Generally, lenders assess your financial stability and ability to repay the loan. This evaluation primarily focuses on your credit score, income, employment history, debt-to-income ratio, and down payment amount. Enhancing […]

Understanding an Escrow Account An escrow account is a legal arrangement where a third party temporarily holds and manages funds or assets on behalf of two parties involved in a transaction. These accounts are often utilized in real estate transactions, but they are also applicable in various other industries where secure handling of funds is […]